Music number one is DJ welcome back to our series on military divorces or, as you saw, the military divorce minefield. Is there a better way to describe it? At least from my perspective, I think not. It certainly seems like we're walking through a minefield, no matter which side of the party you're on. Even if you're a retirement services officer trying to give advice, it seems like a pretty dangerous path to follow. So this week, let's talk about one that is the nastiest - division of the retired pay. This is what causes much wailing and gnashing of teeth for both parties in the divorce. And that is the division of the retired pay. This is easily the one that causes the most spite, the most disagreements, and the most emotions in court. In no other area have I witnessed a level of argument and emotion as I have with the vision of it. Adding to the confusion on both sides, though, is the fact that every state treats the division of retired pay differently. Every single one. For example, Frederico does not divide military retirement at all. Indiana requires the service member to be eligible for retired pay, meaning having 20 years of qualifying service already at the time of divorce, or they will not divide anything. On the other hand, North Carolina requires expert testimony attesting to the value of the retirement frame. The pension gets weirder. Maine does not allow for the confrontation of cost-of-living allowances (colas) when awarding retired pay to a former spouse. So, if they do give health to a former spouse, they would have that rate, only the dollar never goes up. Some states are "shall divide" states, others are "oppression shall divide" states. So, depending on the state, the judges and the...

Award-winning PDF software

Dd 2656-5 Form: What You Should Know

Apple and Mac are registered trademarks. These products are not sponsored by, endorsed by, or associated with the U.S. government, including the Treasury, the Federal Reserve System or any branch, agency or subdivision thereof. DEAD/DD Forms 2656-5, RCS BP Election Certificate, August 2011 DEAD 2460-5, RCS BP Election Certificate, March 12, 2007, DD 2460-5a, RCS BP Election Certificate, February 21, 2007, DD Form 2553-1, Application for Disability Compensation, January 17, 2016 DEAD 2480-5a, RCS BP Election Certificate, September 9, 2015, DD 2656-5, Retirement Notification, July 2013. DD Form 3825, Retirement Reassignment Notification, October 26, 2013. DEAD 2656-5, Retirement Notification, March 12, 2007. DD Form 2656-5, RCS Election Certificate, February 6, 2006. DD Form 2656-5, RCS Election Certificate, January 29, 2006. DD 2656-5, RCS Election Certificate, December 7, 2005. DD Form 2656-5, RCS Election Certificate, November 17, 2004. DD 2656-5, RCS Election Certificate, November 4, 2004. DD 2656-5, RCS Election Certificate, October 24, 2004. DD Form 2156-1, Application for Disability Compensation, June 27, 2005. DD 2655-1, Retirement Notification, May 13, 2005. DD 3260-5A, RCS BP Election Certificate, July 17, 2002. Appendix II The instructions for Form 2553-1 and Form 2656-5 may be found on the links in the table below. Appendix I'm Filing Instructions for the Retirement Reassignment Notification (RNN) Appendix J Appendix K: Social Security Numbers and Social Security Numbers Appendix L: D&O Forms Appendix M: Filing Instructions for D&O Forms Appendix N: Miscellaneous Instructions (a) For more details on the Federal Retirement Thrift Investment Plan (FIR TPO) contact Treasury Direct at. Additional phone numbers for the Fidelity Funds, IRA and Trust Plan Matching Plan are or, respectively.

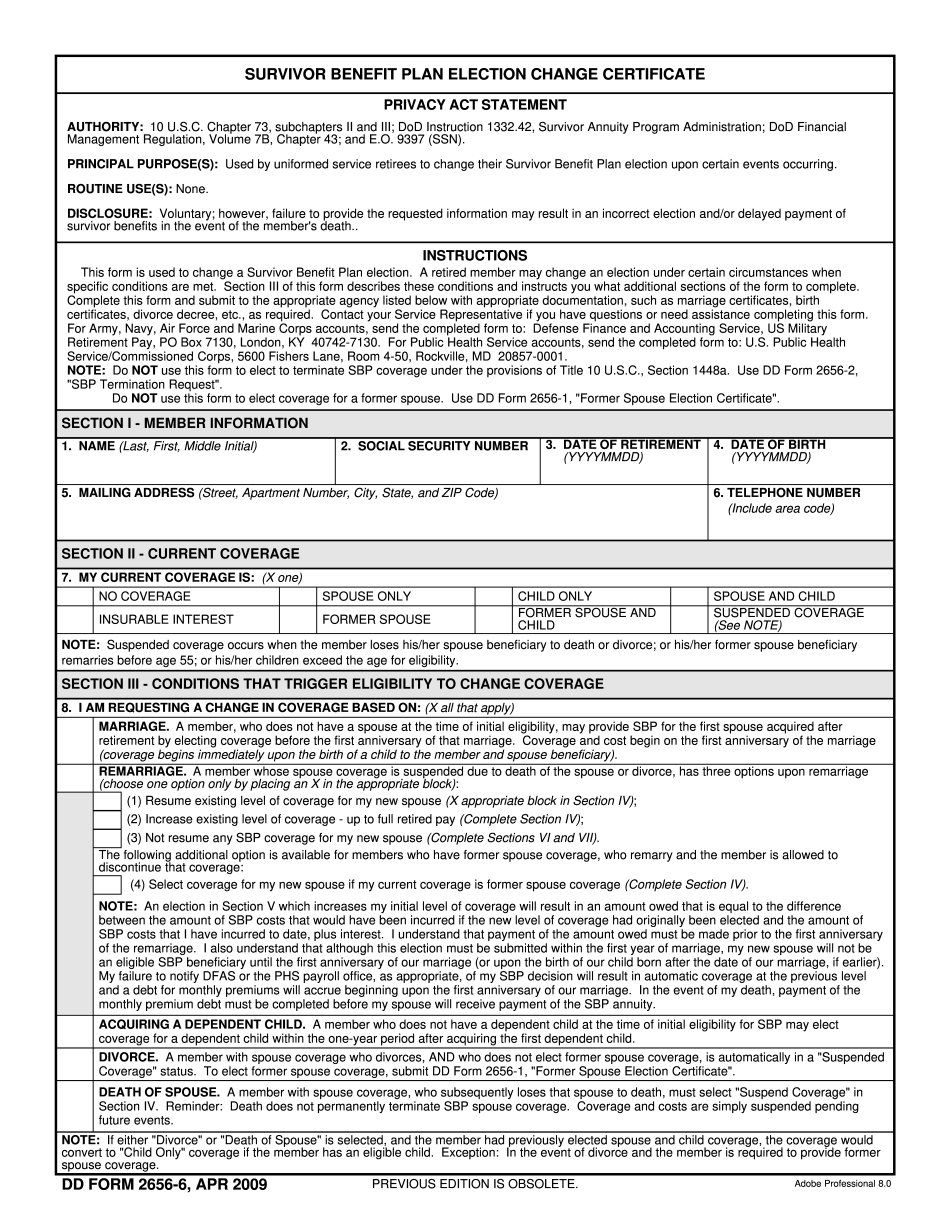

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do DD 2656-6, steer clear of blunders along with furnish it in a timely manner:

How to complete any DD 2656-6 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your DD 2656-6 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your DD 2656-6 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Dd Form 2656-5