When you finally reach the point of being eligible for retirement from the military, you will be faced with a very important decision: sign up for the survivor benefit plan or not. Most servicemembers don't know exactly what this plan is or whether to enroll or not. My name is Mitchell Hockenberry, and I'm going to explain to you what the survivor benefit plan is all about. Okay, admit it. You have been banking on getting 50% of your base pay at retirement for a long time. And now all of a sudden, the benefit folks at your tax class are telling you that you and your spouse need to make a decision of whether to enroll in a survivor benefit plan or not. There are lots of jargon words thrown around - annuity, beneficiary, COLA, premium multiplier, percent, and threshold. Well, you've come to the right place. I'm going to make this clear. Let's begin with an explanation of your pension. When you retire, you will get a pension. This pension has been paid into since the first day you entered military service. It will pay you for the rest of your life - your life, not your spouse's life. If you outlive your spouse, good to go. You receive a pension for both of your lives. But if you die and your spouse is still alive, the pension ends. Again, the pension is paid during your life. The survivor benefit plan is there for this exact scenario. If you are willing to take a smaller monthly pension, then when you die, your spouse - you know, the survivor part of the survivor benefit plan - will benefit by getting a monthly amount of money. This amount is not the same as your pension. It is 55% of your pension. Now,...

Award-winning PDF software

Dd 2656 2025 Form: What You Should Know

Apple and the Apple logo are either registered trademarks or trademarks of Apple Inc. in the United States and/or other countries.

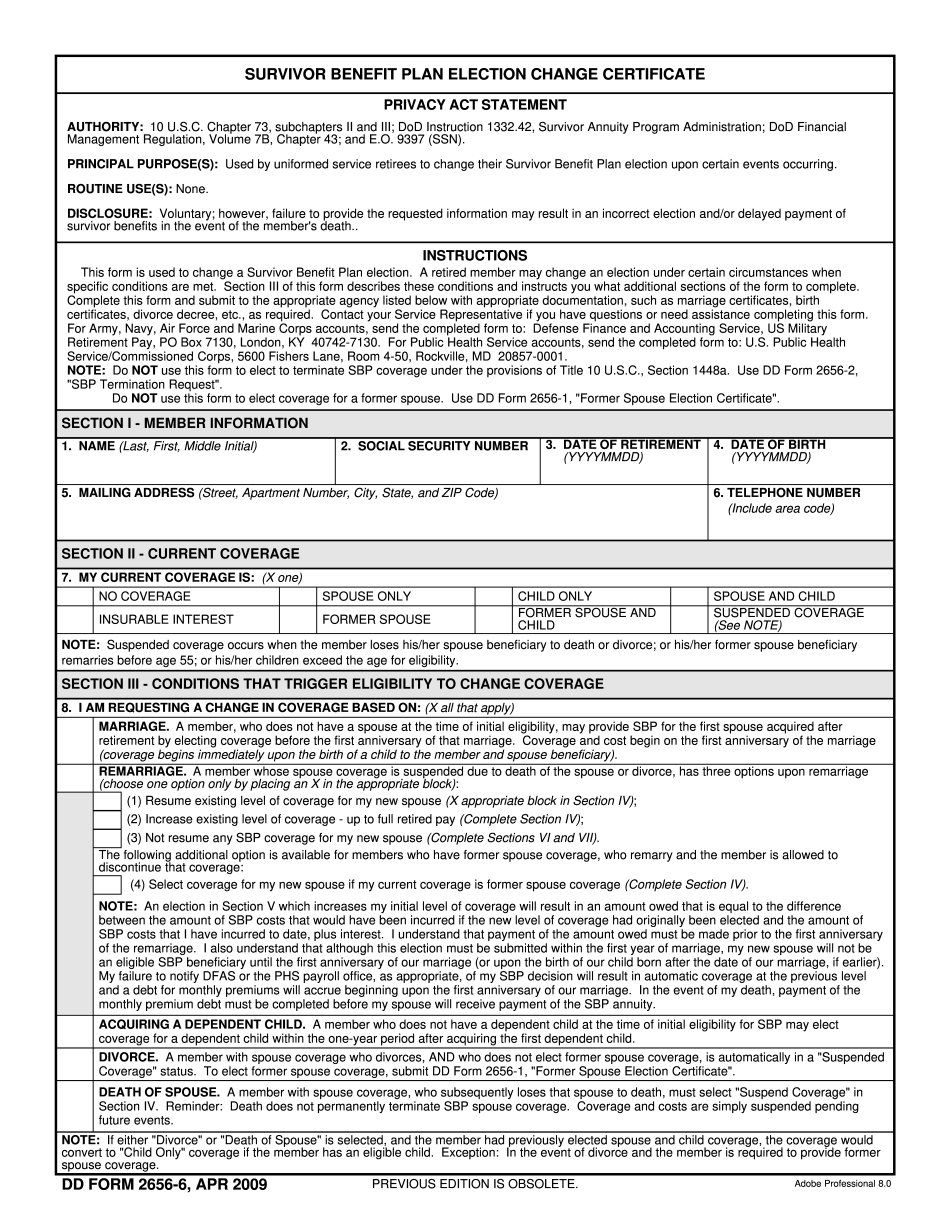

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do DD 2656-6, steer clear of blunders along with furnish it in a timely manner:

How to complete any DD 2656-6 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your DD 2656-6 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your DD 2656-6 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Dd Form 2656 2025