Award-winning PDF software

Dd 2656 oct 2025 Form: What You Should Know

The correct contents of this document and the content of the message window are correlated. If you cannot download images, the contents may not be accurate or the correct information may be missing or incorrect. If this message seems to be appearing repeatedly, you may have been viewing the message window from an older version of Adobe Acrobat software. It may be best to update your software to the current PDF version. If you have not completed part 1 of this document, click here to download the latest version. Please note: If you receive a confirmation message from the US Department of Defense retirement system notifying you that your information has been collected, but you do not receive a confirmation e-mail from your former spouse's retirement system, then you must complete part 2 of the DD 2656 (described above) first. You may receive one e-mail as detailed below. If you are not an immediate family member or the dependent descendant of your former spouse, you need to check the DD Form 2656-A (the beneficiary form), but only for the spouse of one immediate family member. Do not complete Part 2. For the first time, you may receive one e-mail as detailed below. Part 1 : Payment of the Retirement Benefits in the Case of Separation or Death of the Service member and the Payment of Benefits in an Unspecified Amount to the Dependent This section outlines the information you should know regarding the payment of benefits in the case of separation or termination of the service of the dependent. You, and your former spouse, will receive retirement benefits when separated or terminated from the military service. In the case of separation or termination of service, when a retiring member of the uniformed services dies, the surviving retiree will receive an annuity equal to the sum of: (a) the date of retirement; (b) the amount the member had contributed to the retired pay before that date; and (c) for members whose last period of active service began before 1 September 1954 and who were age 62 or older on that date, the amount by which the member's gross annual salary increased pursuant to the table provided in 2 U.S.C. 656(i)(1)(B) during that period.

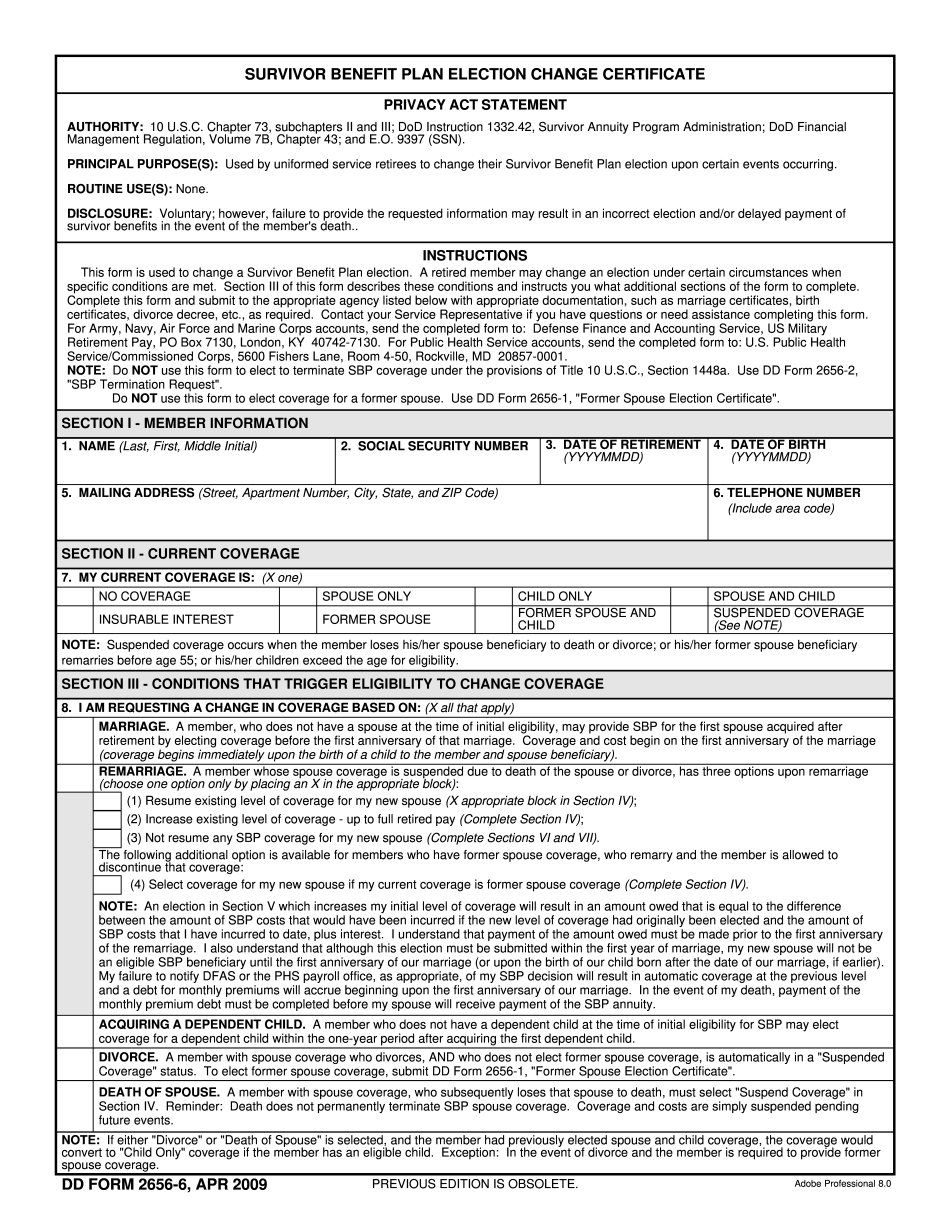

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do DD 2656-6, steer clear of blunders along with furnish it in a timely manner:

How to complete any DD 2656-6 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your DD 2656-6 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your DD 2656-6 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.