Let's just jump right into number two of our readiness statements. It reads as follows: "I have considered my survivor benefits and life insurance options and have chosen the best route to ensure my pension for my spouse or family members." Now, that's a mouthful, but can you confirm that statement in your planning? When we actually look at the retirement paperwork for individual federal employees, this is one of the more complicated pieces of the application for retirement. You have to elect a survivor benefit that looks like the following: if you are a CSRs employee, you can choose up to a fifty-five percent full survivor annuity at a cost of about ten percent. You can also choose to leave your spouse anything less than 55 percent at a lesser cost or you can leave no survivor benefit. There are some minimal costs of two and a half percent on a little bit and then 10 percent on everything else. If you're a fur in, you can leave your spouse 50 percent of your pension. It'll cost you 10 percent for the rest of your life, or 25 percent at a cost of five percent for the rest of your life, or no survivor benefit. These are choices that you make at retirement and we stress day-in day-out to be a wise consumer of this choice. Make sure that you can confidently make a good selection that fits you and your family and your purposes for your money as you move forward. Now, think about this benefit for just a moment. You have a survivor benefit that says if you die, someone else gets a benefit. We know that as life insurance. So, let's take just a moment and briefly compare the survivor benefit to life insurance. Now, as I do this,...

Award-winning PDF software

Dd 2656 jan 2025 Form: What You Should Know

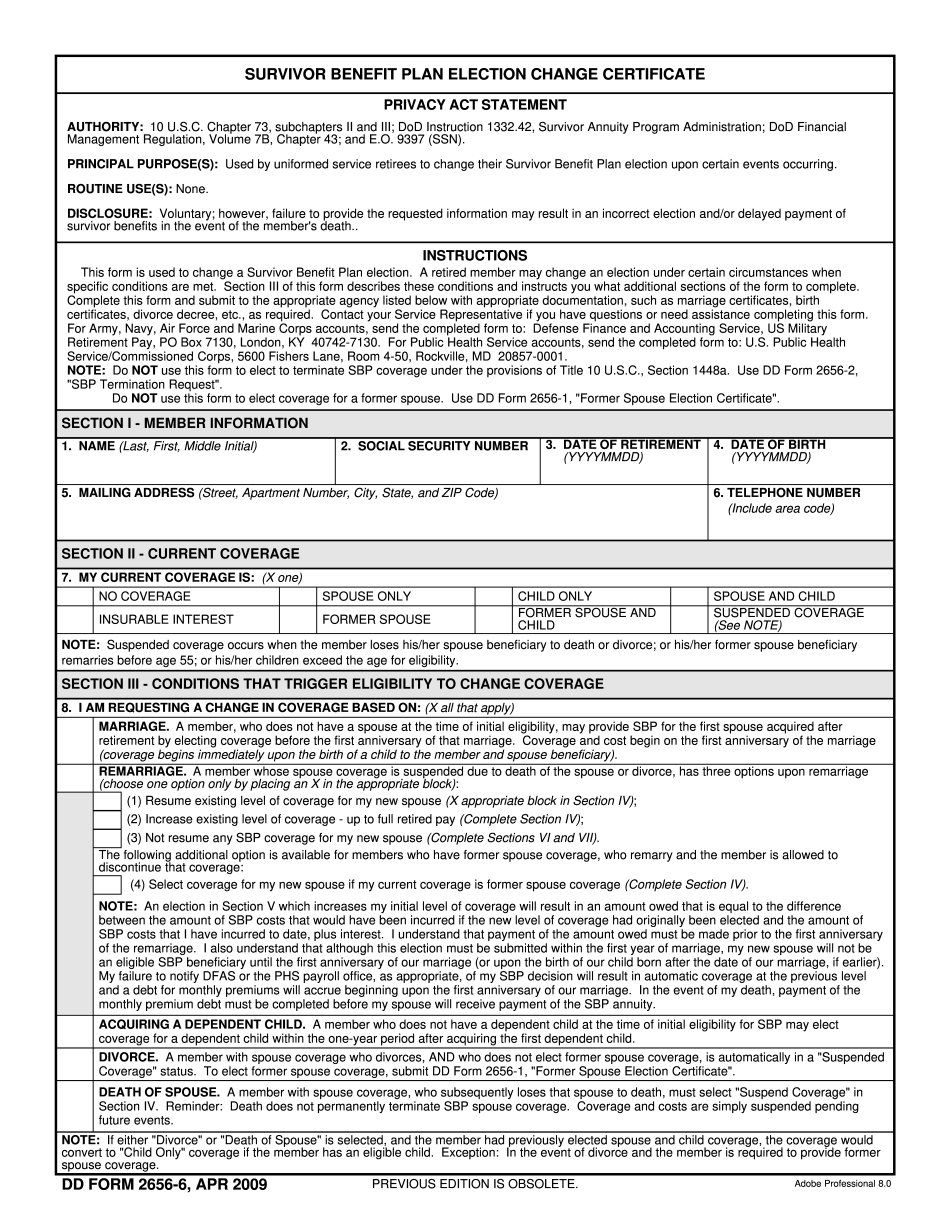

PDF Form DD 2656, Payment of Retiree Personnel. The DD Form 2656-1, “Survivor. Benefit Plan (SVP) Election Statement for Former Spouse Coverage,” must also be completed and accompany the completed DD Form DD 2656. There is no need to fill out a separate DD Form 2656 for a beneficiary of the spouse's retirement. It should be noted, however, that a separate form must always be on file for a beneficiary because the beneficiary is only eligible to receive his or her benefit in the year in which the former spouse applies for the benefit. PART III — RETIRED PERSONNEL — FAMILY PRIVATE PLANS AND SECURITY-FORWARDING PLANS PAYMENT OF RETIRED PERSONNEL Form DD-1054.pdf Form DD-1056.pdf Form DD 1056, Statement of Termination of Benefits. Acknowledgement of Pay. This notice gives the former spouse the specific reason for the termination of benefits and is usually sent by the military officer at least six weeks before the date of termination. If you believe that you were terminated for any reason other than an unlawful discrimination, you must be eligible to receive an income-based annuity. Form DD 1056-EZ.pdf Form DD-1056-H, Hardship Annuity Application. Here an applicant is able to apply for disability annuities to meet his or her income. This form does not provide information on the type of disability annuity the former spouse is entitled to. You should provide this information when you submit the DD-1056-EZ and DD-1056-H for benefits. Form DD 1056-A, Notice of Termination. This notice is sent to all retired services and is posted on the Department of Defense website. Form DD-5094/10, Military Disability Annuity (MAP); Notice of Termination of Benefits; Form DD-5006 (the DD-5094 was changed to DD-5006 as of Jan. 10, 2010). Form DD-5106 (as amended, DD-5106A and DD-5106B). Both these are two separate forms; there are two different forms to be included.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do DD 2656-6, steer clear of blunders along with furnish it in a timely manner:

How to complete any DD 2656-6 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your DD 2656-6 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your DD 2656-6 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Dd 2656 jan 2025