Award-winning PDF software

Dd 2656-2 Form: What You Should Know

SVP Termination Request. 2. Applicability: This form is used to voluntarily discontinue participation in the Survivor Benefit Plan (SVP) that has been terminated for failure to pay any federal income tax liability from January 1, 2019, through December 31, 2019. The SVP is a tax-deferred retirement plan. You must have been a participant in the SVP when SVP coverage was terminated and your participation was terminated because of an SVP terminations and removals. Send the completed form and supporting documentation to DIAS DD 2656-5, SVP Election Form, May 2017 Your spouse and dependent children are not eligible or not subject to the SVP unless they were eligible in a retirement plan that has been terminated for failure to pay any federal income tax liability. DD Form 2656-2, SVP Termination Request For retired spouses, if you wish to terminate the Survivor Benefit Plan coverage that is being terminated for failure to pay any federal income tax, you submit a DD Form 2656-2, SVP Termination Request. DD 2656-2, SVP Application for Termination, June 24, 2018, If your income has been reduced by 3,000 or more from the date you became subject to the SVP, or if your health care services were cancelled due to a change in your diagnosis/condition, your SVP coverage will continue until such time as you have reached 50 percent of the applicable amount for an employee and a dependent, or, for a dependent aged 65 and/or older, 3,600. See IRM 1.5.1.36.26. Example. The retired employee's monthly benefit is 5,600. The annuitant's monthly benefit is 4,300. The annuity terminates because she has achieved the maximum pension credit. The retired employee has reached 50 percent of the maximum pension credit, having attained 2,300. An SVP termination is necessary. An SVP termination must be done if the annuitant's annualized retirement benefit will be 3,600 or less. Under these facts, termination of an SVP termination remains permissible provided that an annuitant is currently entitled to the maximum pension credit available to the annuitant under the SVP plan and there is no evidence in the annuitant's files that the annuitant will no longer be able to attain this pension credit. Example.

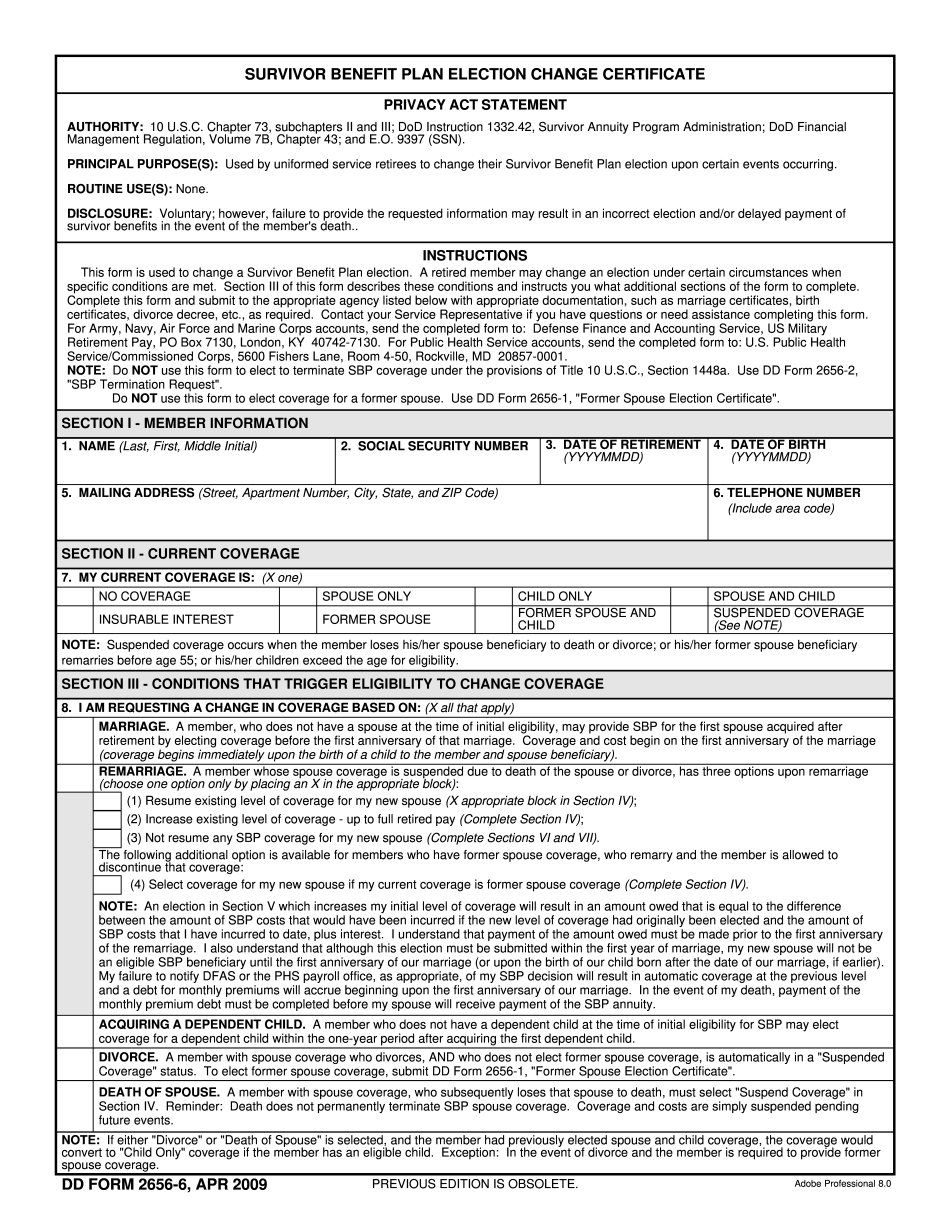

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do DD 2656-6, steer clear of blunders along with furnish it in a timely manner:

How to complete any DD 2656-6 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your DD 2656-6 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your DD 2656-6 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.